|

|

|

United Gin Corp.

Market Data

News

Ag Commentary

Weather

Resources

|

Are Wall Street Analysts Predicting CMS Energy Stock Will Climb or Sink?

CMS Energy Corporation (CMS), valued at a market cap of $21.8 billion, is a leading provider of electric and gas services to 1.9 million and 1.8 million customers, respectively, through its Electric Utility, Gas Utility, and NorthStar Clean Energy segments. It generates power from various sources and operates an extensive distribution and storage infrastructure. Shares of CMS have lagged behind the broader market over the past 52 weeks, gaining 8.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.1%. Moreover, CMS shares are up 9.7% on a YTD basis, compared to SPX's 10% gain. Looking closer, the energy company has also trailed the Utilities Select Sector SPDR Fund's (XLU) 14.4% return over the past 52 weeks and a 13.7% YTD gain.

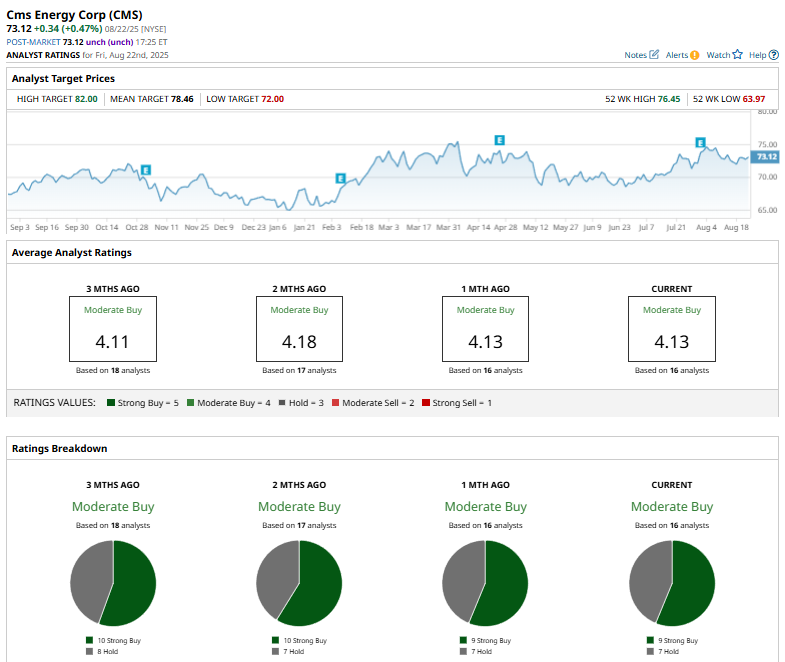

On Jul. 31, CMS Energy posted solid Q2 2025 results, with adjusted EPS climbing to $0.71, well above analyst estimates. Its operating revenue jumped 14.4% year over year to $1.8 billion. The company benefited from constructive regulatory outcomes, favorable weather, and disciplined cost controls. Despite the financial headwinds from the costliest storm event in its history, CMS reinforced its full-year adjusted EPS guidance of $3.54–$3.60, signaling confidence in meeting its annual targets. As a result, its shares climbed 2.3% post-earnings release. For the fiscal year ending in December 2025, analysts expect CMS' EPS to grow 7.2% year-over-year to $3.58. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion. Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings and seven “Holds.”

This configuration is bearish than two months ago, with ten “Strong Buy” ratings on the stock. On Jul. 22, Barclays analyst Nicholas Campanella raised CMS Energy’s price target from $77 to $78 while maintaining an “Overweight” rating, citing optimism for the power and utilities sector. CMS’ mean price target of $78.46 indicates a premium of 7.3% from the current market prices. The Street-high target of $82 implies a potential upside of 12.1%. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|